Transaction refinancing

How I spotted a product opportunity understanding our users

Role

Duration

Product Designer

3 to 4 Months

Team

Product Manager, Customer Support, Consumer Insights (research partner), Data Analyst, Engineer & Mexico design team.

Context

Nubank launched a 🚀 BETA version in Colombia around February 2021, reaching 10K customers in the first month.

After 6 months of using our product, we identified an unexpected type of payment that wasn’t available at the moment.

What happened?

Customers did something called a ”balance transfer” where they take the debt out to pay it with their main bank. In other words, their main bank paid their debt with us offering lower interest and reducing the debt amount they’ll pay with them.

PM: “We need to create a balance transfer process”

ME: “Let's understand first, why they're doing this before making a decision.”

Skills

User Research

1 - 1 Interviews

Prototyping

Unmoderated Testing

UX Writing

Surveys

Product Prioritization

A/B Testing

🕵️ Understanding the user

The first thing we did was to set up an unstructured 30-minute interview with the customers who made the balance transfer to understand the rationale behind it and if it's a common practice.

What did we find?

They wanted to change the instalments or renegotiate one of the transactions they did with the credit card.

Additionally, from other data sources, we identified problems with instalments as one of the top reasons for contacting support.

We didn't have researchers at the time, so we partnered with the consumer insights team (Marketing intelligence) to launch a Quantitative survey where we wanted to:

Understand the relative importance of a set of features (prioritization).

Collect motivations and behaviors regarding the change of instalments (mental model).

🎯 Finding opportunities

*Features to reduce instalments and allow paying a specific transaction were valued as a differentiation point from competitors, while offering and online option to pay your credit card was an important parity component.

We were trying to change priorities on the roadmap and bring this features first.

🔬 Interviews and concept testing

I conducted a series of 6 moderated interviews, where the main objective was to identify the common pain points users have at the moment to change instalments and needs on how the product should enable this option at any point in their billing cycle.

After analysing the insights we found that: flexibility, clarity and impact on their next bill, were in the top 3 most common needs, the good part: none of our competitors offered them a solution to their problems.

Control on changing the number of instalments after making a transaction when they don't have the option to choose (i.e.: subscriptions, International, contactless, especific merchants).

The option to decide and have flexibility on how much they pay on each bill or have the chance to pay for specific transactions at any time.

Straightforward process that is quick, easy, and also transparent about the conditions (i.e.: interest, next bill impact, time to be confirmed, transactions rules).

They expect support from their banks when they have an issue with a POS, gateway or merchant after making a transaction.

Full knowledge about their cash flow, payday and close date, to decide the number of instalments. In some cases they prefer to accumulate debt than run out of cash.

Decide the amount of instalments based on the type of each transaction beforehand (i.e.: international, contactless, withdrawals, etc…)

“I’d have liked them to tell me how my debt was, it’s going to be this # of instalments for this value and it will take so long to pay off the debt.”

Analysis of the interviews, identifying themes, pain points and highlighting opportunities.

👩🔬 A/B experiment

Now that I know what the pain points and needs our users have, I created an A/B test based on our learnings.

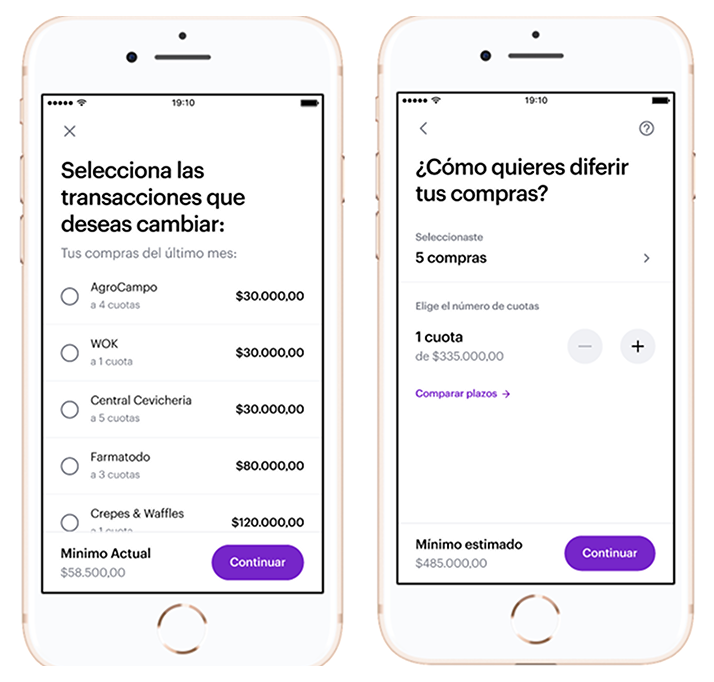

Minimum refinancing

Offering a new way to refinance their next minimum payment (debt-based).

27% expected this and 26% said it would be very necessary to have it

Case by Case

To leverage the current experience in the Mexican product and speed up the technical implementation.

32% expected this and 41% said it would be very necessary to have it

Our bet

Multiple tx refinancing

Option to select +1 tx to change the instalments reducing the min payment.

42% expected this and 37% said it would be very necessary to have it

📲 Defining the user flow

Key teams and stakeholders involved during the design process

Content designer was involved during the process to define the copy and structure throughout the flow including email comms.

Engineers closely involved in estimating effort, refinement of the project, creation of tasks stories and understand the flow of users.

Mexico design team consulted as they worked on a similar experience to understand what was built and what can be used as examples.

Upper management informed on decisions, updates and follow-ups on the progress during the interviews and implementation of the project.

Worked the Design system team to ensure all components were part of our main library and best usage of current patterns and flows.

And of course, the Product Manager was an important part of this project as the main ally and support partner.

🎨 Final experience

💡 What did I learn after?

Design can make a difference

By digging deeper and pushing to do things differently, design can deliver and drive more strategic value to the business than just making interfaces.

How to launch this to customers?

For me, working with the brand at the same level as the product was new to me. Thinking about how to communicate earlier was crucial.

Get support from other areas

Part of building strong relationships and making stronger connections, is to work closely with areas like support, CI, or eng, this help us to have more impact

Leverage what you already have built

Taking learnings and using things we already have from other countries helped us work faster and deliver value more often.

Customer obsession is key

You are the voice of the customers against the decision makers. Having data and a clear outcome can help you grab their attention.